Category: Gift Tax

A slight increase could bring estate tax exemption for couples to $11 million. Analysts are projecting the IRS will increase estate tax exemptions for 2018, as well as boost the annual gift tax exemption, according to Forbes in “Estate Tax Exemption To Top $11 Million Per Couple in 2018.” Analysts forecast an increased exemption for […]

Trustees need to plan for automatic termination of Great Depression trusts. Dynastic trusts from the days of the Great Depression are near expiration and planning is required, according to Wills, Trusts & Estates Prof Blog in “Preparing for Trust Termination.” Most of the trusts created at that time have mandatory termination dates at which time, […]

One generally donates to a charitable organization but you can also help individuals. But be wary of rules if you are planning a deduction. If you want to donate to specific individuals rather than an established charity then you have to follow the rules if you plan on tax deductions, according to Wills, Trusts & […]

A family member may need more than the $14,000 annual gift tax exemption allowed and a loan can sometimes be the answer. The annual gift tax exemption of $14,000 ($28,000 for a couple) is sometimes sufficient in terms of gifting money, but a specific reason for the gift could push that number higher. A loan […]

As end of year approaches, it is time for celebration, holiday gifts and tax planning. Tax consequences often need to be considered when it comes to giving some gifts on holidays while others—small, less expensive gifts—fall under the radar and have no major tax implications. However, what if you want to give something bigger, such […]

The Affordable Care Act or “Obamacare” has had an impact on the taxes of investment income but estate planning techniques can reduce it. The intention of the Affordable Care Act was to increase the number of recipients of health insurance without increasing costs. While the accomplishments of the Act are often debated it appears the […]

Taxes and inheritance issues go together like Halloween and trick or treating. Tax planning is a critical part of estate planning, and families who wish to transfer assets from one generation to the next need to prepare for both aspects, as settling an estate can easily become quite complicated. Many estate plans include the use […]

Collectors of fine art are advised not to think of their collections as investments, but collectors cannot ignore the value of their art portfolio, nor should they fail to consider what will happen to the artwork when they are not around to appreciate it. And as the art portfolio grows in value, whether through acquisitions […]

Technically speaking, whenever you give a gift to someone, you have to follow the gift-tax rules. You don’t have to file a gift tax return every time you give someone a birthday present or a bouquet of roses, but it’s useful to know when the gift tax – embodied in IRS’ Form 709 – needs […]

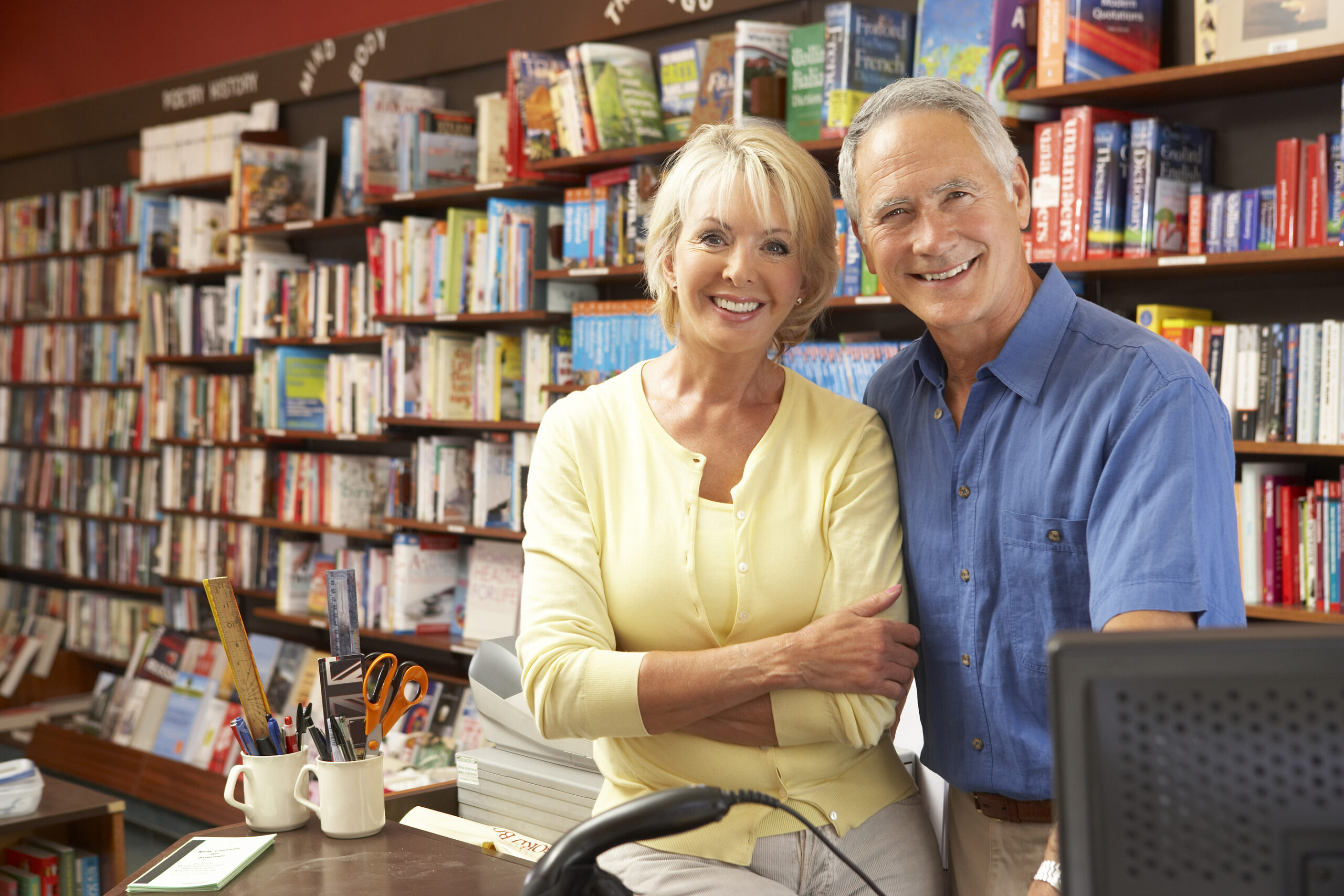

Whether it’s a farm or a manufacturing facility, family businesses are a key part of the global economy. Family business owners are not always very good about keeping their estate plans up to date. Circumstances change: the value of the business may grow or shrink, relationships within the family may change, and tax laws change. […]